Comprehending the Kinds Of Offshore Financial Investment and Their Special Attributes

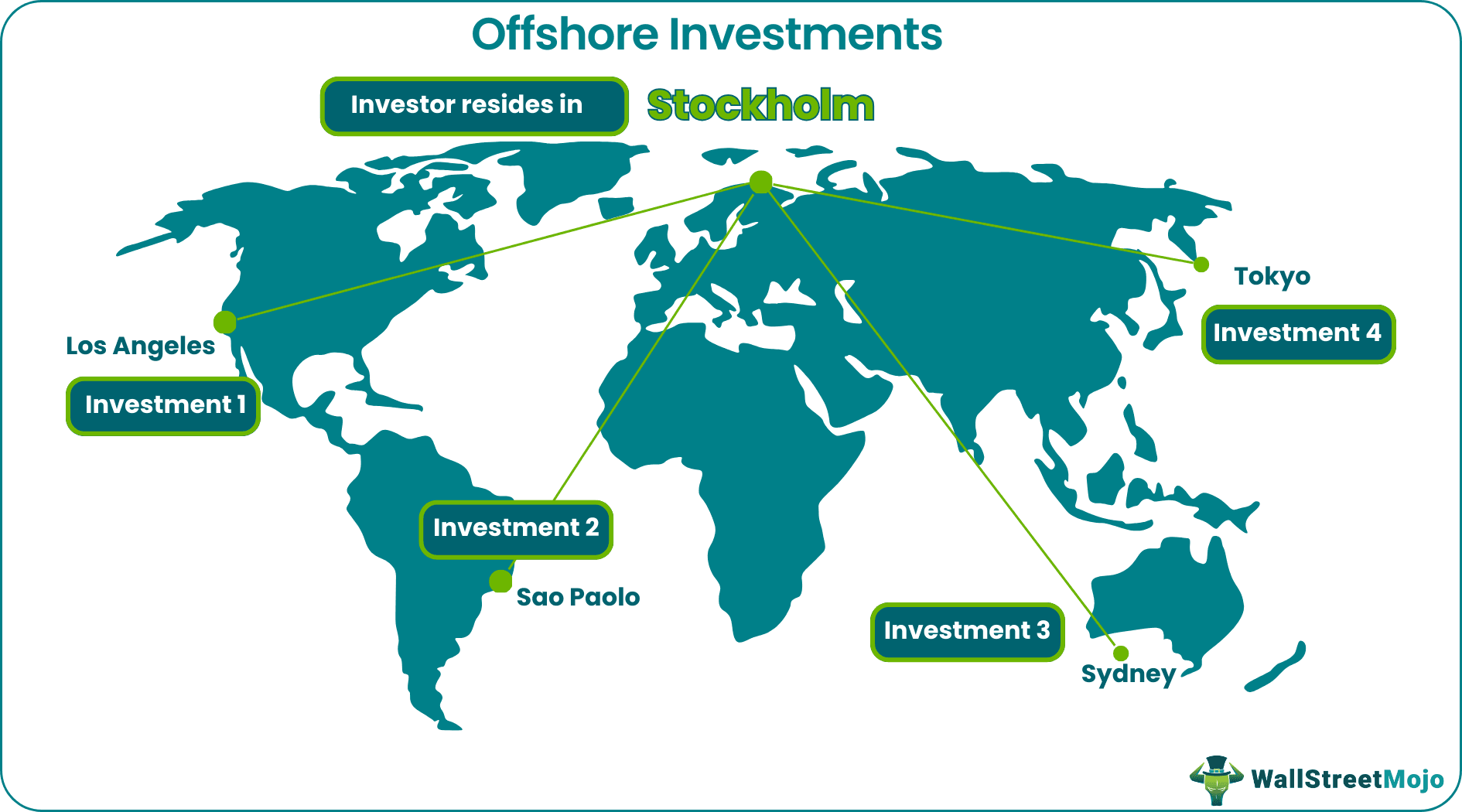

In an increasingly globalized economy, comprehending the different kinds of offshore investments is essential for effective wealth management and asset protection. Each financial investment lorry, from overseas financial institution accounts to shared funds and depends on, uses unique functions tailored to satisfy varied economic objectives. The nuances of these choices can dramatically affect tax obligation liabilities and risk direct exposure. As we check out the ins and outs of each type, it comes to be noticeable that the ideal choice can lead to boosted economic safety and opportunities. What, then, are the details advantages and factors to consider that establish these offshore financial investments apart?

Offshore Financial Institution Accounts

Offshore bank accounts work as a critical monetary device for people and businesses seeking to diversify their properties and manage currency threat. These accounts are usually developed in jurisdictions that use favorable banking laws, privacy defenses, and a stable political and financial environment. By holding funds in varied currencies, account owners can efficiently mitigate the threats related to currency changes, making certain higher economic stability.

Nevertheless, it is important to abide with all relevant tax laws and policies when making use of offshore financial services. Failure to do so might lead to economic penalties and lawful effects. Possible account owners should look for expert suggestions to browse the intricacies of overseas banking and ensure they are fully compliant while enjoying the advantages of asset diversification and risk monitoring.

Offshore Mutual Funds

Purchasing shared funds can be an efficient technique for people looking for to gain access to worldwide markets while gaining from specialist administration and diversity. Offshore mutual funds offer as an engaging choice for financiers wanting to profit from possibilities past their domestic markets. These funds swimming pool capital from multiple capitalists to spend in a diversified portfolio of assets, which may consist of equities, bonds, and alternate financial investments.

One of the primary benefits of offshore mutual funds is the potential for boosted returns via access to international markets that might not be readily available domestically. These funds typically provide tax benefits depending on the jurisdiction, permitting investors to maximize their tax liabilities. Additionally, professional fund supervisors actively take care of these investments, making educated decisions based on extensive research and market evaluation.

Financiers in overseas mutual funds gain from the flexibility to select various fund techniques, varying from conservative to aggressive financial investment approaches. This range allows people to align their investment selections with their threat tolerance and monetary objectives. Nonetheless, it is vital for capitalists to conduct complete due diligence and understand the regulatory atmosphere, charges, and threats related to these investment cars before dedicating funding.

Offshore Trust Funds

Trusts stand for a strategic financial device for people looking for to manage and safeguard their properties while possibly gaining from tax effectiveness. Offshore Investment. Offshore depends on are established outside the individual's home nation, permitting for improved possession protection, estate preparation, and personal privacy benefits. They can protect check out this site assets from financial institutions, lawful insurance claims, and divorce negotiations, making them an enticing choice for rich individuals or those in high-risk professions

In addition, overseas counts on can provide substantial tax advantages. It is essential to browse the lawful complexities and compliance needs connected with overseas depends on, as failing to do so can result in extreme charges.

Offshore Property

A growing variety of financiers are turning to realty in foreign markets as a method of diversifying their profiles and taking advantage of global chances - Offshore Investment. Offshore realty financial investments provide a number of advantages, consisting of potential tax advantages, asset defense, and the opportunity to obtain buildings in emerging markets with high development possibility

Purchasing offshore actual estate allows individuals to profit from favorable property legislations and laws in certain jurisdictions. Several nations provide rewards for international investors, such as decreased tax on resources gains or revenue generated from rental residential properties. Moreover, having genuine estate in an international nation can offer as a bush versus money variations, providing stability in volatile economic climates.

In addition, offshore actual estate can create pathways for residency or citizenship in certain jurisdictions, boosting economic and individual movement. Investors often look for residential properties in prime places such as city centers, playground, or areas going through substantial advancement, which can produce appealing rental returns and lasting gratitude.

Nonetheless, potential capitalists should perform extensive due persistance, understanding regional market problems, legal frameworks, and property administration effects to maximize their offshore realty financial investments efficiently.

Offshore Insurance Policy Products

Exploring overseas insurance coverage items has actually come to be an increasingly prominent method for people and organizations seeking enhanced monetary safety and security and possession security. These products provide special benefits, including tax obligation advantages, privacy, and versatile investment choices tailored to personal or corporate needs.

Another significant group consists of health and traveling insurance, which may use detailed coverage and protections not offered in the insurance holder's home nation. These products can be particularly valuable for migrants or frequent travelers who deal with special risks.

Eventually, overseas insurance coverage items provide an engaging alternative for those looking to reinforce their monetary techniques. By offering customized remedies that stress personal privacy and tax obligation effectiveness, they can play a crucial role in a varied financial investment portfolio.

Verdict

To conclude, overseas investments present varied opportunities for wide range monitoring and possession security. Each kind, consisting of offshore bank accounts, common funds, depends on, property, and insurance policy products, offers distinct benefits customized to particular financial objectives. Utilizing these financial investment automobiles can boost profile diversification, maximize tax liabilities, and provide economic safety. Understanding the unique functions of each offshore financial investment is vital for individuals and entities seeking to browse the complexities of international financing properly.

In an increasingly globalized economic climate, recognizing the various kinds of overseas investments is vital for effective wealth monitoring and asset protection. Each financial investment vehicle, from offshore bank accounts to shared funds and trusts, provides distinctive functions customized to meet diverse monetary objectives.Furthermore, offshore financial institution accounts can give access to a range of monetary solutions, consisting of financial investment opportunities, providing centers, and wide range monitoring services.Financiers in offshore shared funds benefit from the versatility to select different fund methods, varying from conventional to hostile financial investment techniques. Recognizing the special attributes of each overseas investment is necessary for entities and individuals seeking to navigate the complexities of international Related Site money properly.

Comments on “Why Offshore Investment Is a Smart Technique for High-Net-Worth People”